Irs Fuel Mileage Rate 2025

Irs Fuel Mileage Rate 2025. The irs issued the 2025 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business, charitable, medical, or moving. The rates are used to determine the deductible costs of using a vehicle for business, charitable,.

The rates are used to determine the deductible costs of using a vehicle for business, charitable,. If you use your car for business, charity, medical or moving purposes, you may be able to take a deduction based on the mileage used for that purpose.

Irs Mileage Rate 2025 Include Gas Caro Martha, On december 14, 2025, the internal revenue service (irs) issued the 2025 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business,.

Mileage Rate 2025 Calculator Vinny Jessalyn, 67 cents per mile, up 1.5 cents from 65.5 cents in 2025.

2025 Standard Mileage Rates Released by IRS; Mileage Rate Up, The irs has announced the standard mileage rates for the use of a car, van, pickup, or panel truck for the year 2025.

IRS Mileage Rates 2025 A Comprehensive Guide to Business, Finance, and, The irs has announced its standard mileage rates for the use of a car, van, pickup or panel truck beginning on jan.

2025 Mileage Rate Irs Dehlia Layney, The irs has announced the standard mileage rates for 2025, reflecting changes that are important for taxpayers to note.beginning january 1, 2025, the rates are set as.

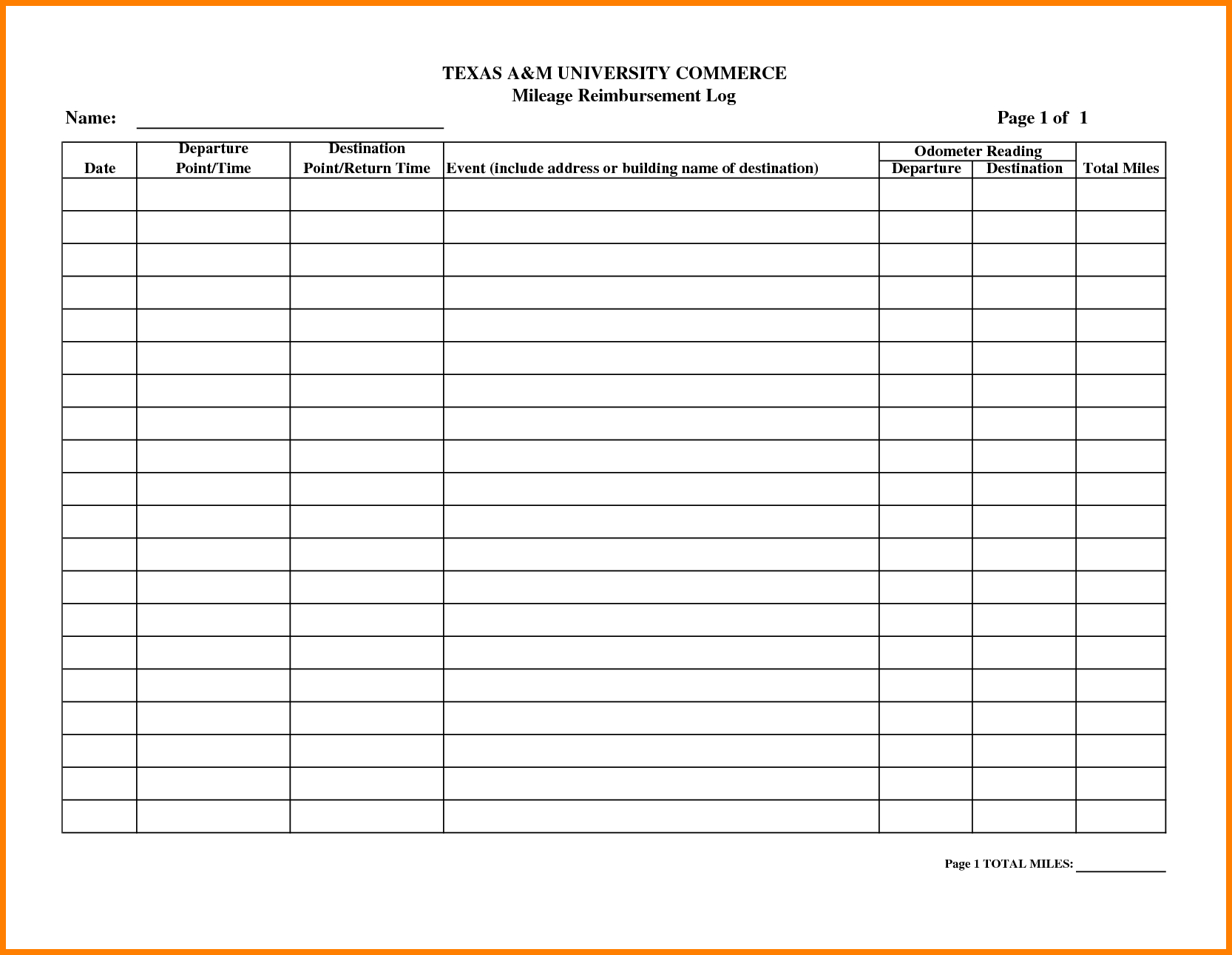

2025 Mileage Reimbursement Rate Irs Glad Philis, The standard mileage rates for 2025 are as follows:

2025 standard mileage rates released by IRS, The standard mileage rates for 2025 are as follows:

Irs Gas Reimbursement Amount 2025 Ynes Amelita, Mileage rate increases to 67 cents a mile, up 1.5 cents from 2025.

Irs Mileage Rate 2025 Form Jamima Selina, The most notable examples include the fuel price spike in 2008 when the.